The Rise of a New Tool for Money Laundering Detection

Introduction

Money laundering is a global challenge that poses a significant threat to the integrity of financial systems worldwide. Criminals employ various techniques to disguise the illicit origins of their funds, making it difficult for authorities to detect and prevent these activities. However, computer scientists have recently developed a groundbreaking tool that promises quicker and more accurate detection of money laundering. This tool utilizes innovative algorithms to identify suspicious patterns in transactions, particularly focusing on the technique of “smurfing,” where large sums of money are divided into multiple smaller transactions across numerous bank accounts.

A team of researchers from the Department of Informatics has devised an entirely novel approach to detecting money laundering. Their innovative algorithms analyze data from multiple bank accounts represented as nodes on a complex graph. By focusing on the part of the graph with the highest suspicious activity, the software can identify instances of smurfing, even when funds are split between different accounts. The researchers assert that their software is over three times more effective than current detection methods and can analyze larger amounts of data.

Current money laundering detection methods primarily rely on rule-based or machine-learning (ML) approaches. These methods often trigger alarms based on pre-set suspicious transaction scenarios, such as excessive cash deposits. While they can be effective in some cases, they may overlook instances of smurfing or other sophisticated money laundering techniques. Moreover, these methods require domain knowledge and historical data to accurately detect attacks. If an organization lacks such data, the accuracy of these methods diminishes.

Advantages of the New Money Laundering Detection Tool

The newly developed software offers significant advantages over existing detection methods. Notably, it can scan a staggering 50 million transactions in less than a second, providing unparalleled speed in detecting money laundering activities. The algorithms employed by the software can identify all combinations of related transactions, even when funds are split between different accounts. This level of precision ensures that no suspicious activity goes undetected.

One of the major limitations of current money laundering detection methods is their inability to analyze large amounts of data effectively. The new tool addresses this challenge by enabling the analysis of vast amounts of data over extended periods. By filtering and sounding an alarm when suspicious activity is detected, the software empowers financial institutions to proactively combat money laundering. This enhanced efficiency allows money laundering experts to survey data more rapidly, enabling them to identify actors with malicious intent efficiently.

The software developed by the researchers is open source, making it freely accessible to financial institutions and other relevant parties. This open nature encourages collaboration and facilitates the development of even more advanced detection methods. Additionally, the new tool’s capabilities extend beyond money laundering detection. Its algorithms could potentially optimize marketing campaigns for retailers by identifying the most profitable product bundles, thereby enhancing retail data accuracy.

The Significance of Combating Money Laundering

Money laundering presents a significant challenge on a global scale. According to the United Nations Office on Drugs and Crime (UNODC), an estimated 2% to 5% of global GDP is laundered annually, amounting to massive sums ranging from £632 billion to over £1.5 trillion. These illicit funds flow through various channels, undermining the stability and integrity of financial systems worldwide. By developing a more efficient and accurate approach to detecting money laundering, the newly developed tool provides a crucial step forward in addressing this pervasive issue.

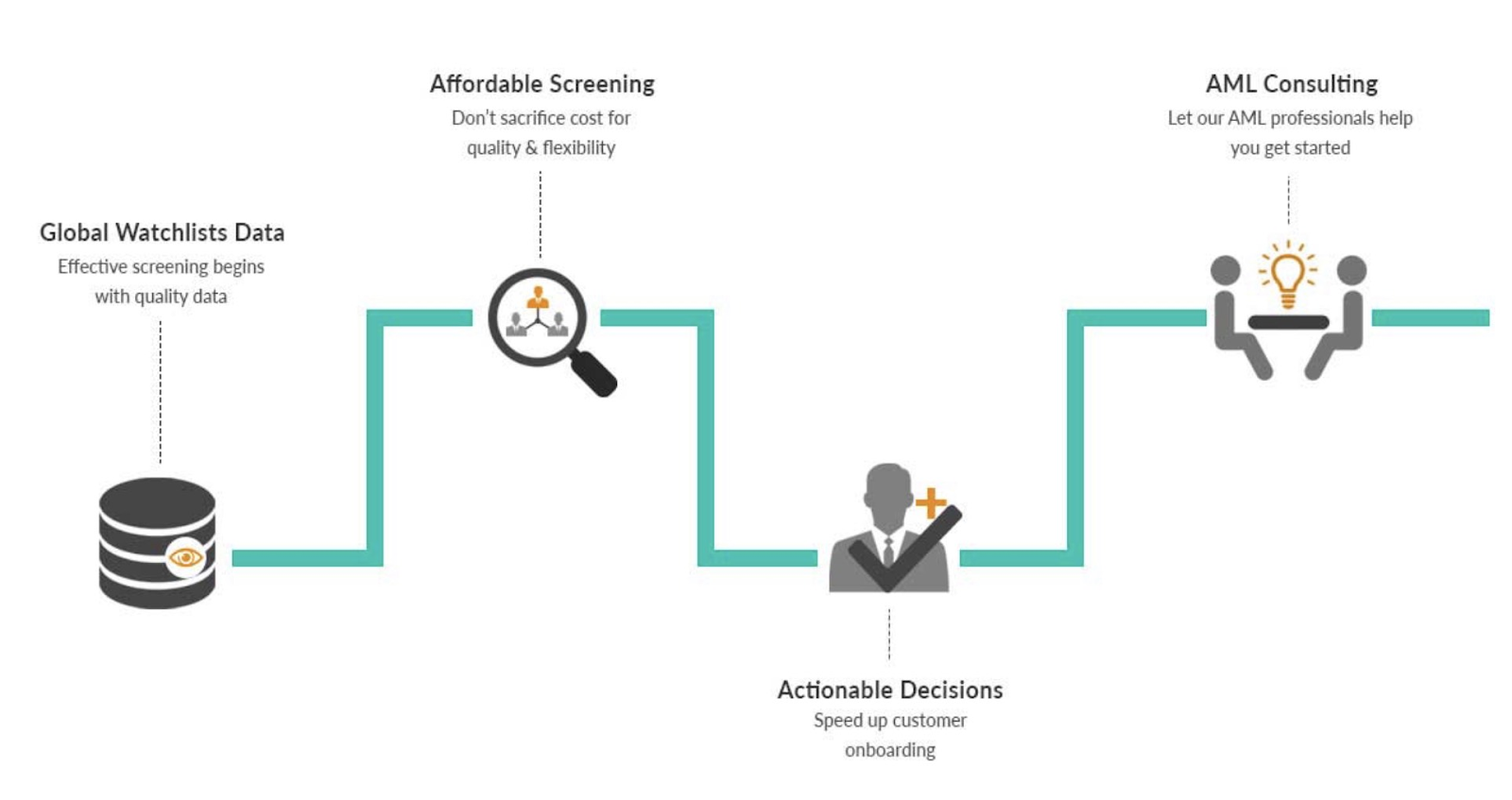

Financial institutions play a pivotal role in the fight against money laundering. Compliance with anti-money laundering (AML) regulations is essential to protect the integrity of the banking sector and the wider economy. Failure to detect and prevent money laundering can result in severe consequences, including reputational damage, regulatory penalties, and increased systemic risk. The new tool equips financial institutions with a powerful weapon to combat money laundering effectively, safeguarding their operations and the financial well-being of their customers.

The Future of Money Laundering Detection

While the newly developed software represents a significant leap forward in money laundering detection, the researchers acknowledge that there is room for further improvement. They are actively working to enhance the tool’s speed and accuracy, aiming to surpass conventional approaches. By continually refining and optimizing their algorithms, the researchers strive to stay one step ahead of evolving money laundering techniques.

The open-source nature of the software encourages collaboration among experts in the field. Financial institutions, regulatory bodies, and other stakeholders can contribute their expertise to improve the tool’s capabilities. By sharing knowledge and insights, the collective effort can lead to more robust and comprehensive money laundering detection methods. This collaborative approach ensures that the fight against money laundering remains dynamic and adaptive.

Conclusion

In conclusion, the development of a new tool for detecting money laundering marks a significant milestone in combating financial crime. The innovative algorithms and data analysis techniques employed by the software enable faster and more accurate detection of suspicious activities, particularly those associated with smurfing. By addressing the limitations of existing detection methods, the tool offers enhanced efficiency, analysis of large data sets, and potential applications beyond money laundering detection. As financial institutions and authorities embrace this technology, the fight against money laundering gains momentum, safeguarding the integrity of financial systems and the global economy.